“Analysis Paralysis” is a Symptom. The Root Cause is an Incomplete Strategy Without Hypothesis.

- David Isaac

- Aug 8, 2025

- 4 min read

Updated: Sep 20, 2025

Every high-performance team hits that moment where no one is SURE of what to do next.

You're staring at a wall of feature requests. A spreadsheet of market segments. A sea of possible GTM plays. And no one agrees on what to do next.

So you run another workshop. Build another dashboard. Design another deck to propose ideas or gather inputs.

And still…No one moves. Or worse, they each follow their own interpretations to move in different directions.

Let’s name what’s actually going on.

This isn’t a prioritization problem. It’s not a process gap. And it’s definitely not because your team “lacks ownership.”

This is the quiet chokehold of strategy without hypothesis.

Here’s what that means:

1. You’re working with incomplete data — especially on non-customers.

Most strategy teams only analyze:

Current users

Known pain points

Confirmed segments

Past performance

That’s like driving while only looking in the rearview mirror.

The greatest growth opportunities, and the greatest risks, might be:

The segments you haven’t explored

The pain points no one is tracking

The competitive gaps you’re not yet exploiting

The customer journeys not yet mapped

If your data excludes what you haven’t built or who you haven’t reached — your strategy is built on shadows.

2. You don’t know which decisions matter most — right now.

Even great teams drown in tactical noise:

"Should we change onboarding?" "Should we add this feature?" "Should we localize for another country?"

But if you can’t rank your strategic choices by:

Expected business impact (on revenue, CAC, NRR, etc.)

Stage of the growth loop (Acquisition, Activation, Retention, Monetization)

Current product-market fit gap…then you’re guessing.

Not executing.

And that leads to the most dangerous lie in strategy:

"Let’s just ship and see."

Launching without knowing what next steps come out of the results is a waste of resources and valuable time that should be capturing market share.

Think "If A happens, then we next do B. If C happens, then we next do D"

3. There’s no single source of strategic truth.

Your research is in FigJam.

Your priorities are in Notion.

Your slides are in Drive.

Your assumptions are in Slack.

And your product, marketing, and sales teams?

They’re all pulling from different truths, working from different maps — none of which update when reality changes.

When strategy isn’t dynamic and shared, alignment is not complete. Teams work hard. They just don’t move business metrics. They aren't targeting to move the same North Star Metric.

4. You’re not thinking in systems, nor pretesting with experiments and simulations.

The real problem isn’t a lack of effort. It’s a lack of modeling.

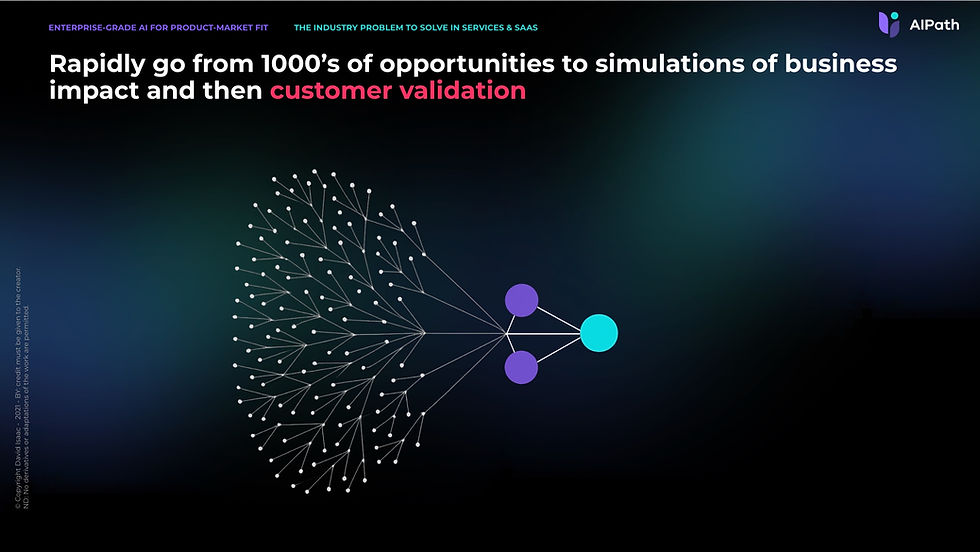

Your team has thousands of strategic permutations they could pursue. But you can only test one… maybe two… per quarter.

That’s not a strategy. That’s more like wearing blinders and hoping your competitors are stealing your customers.

What’s missing is a way to simulate those paths in advance. To identify which bets matter most, before burning engineering time or budget.

This is what elite strategists do intuitively. But most companies don’t have a scalable way to do it systematically.

🔁 The Shift: From “Prioritization” to “Strategy Fit Engine”

When I built the IGE framework — Integrated Growth Execution — I kept running into the same pattern across hundreds of teams:

They weren’t suffering from a lack of ideas. They were suffering from a lack of what priorities and sequences of action were 'best'.

Not just what to build. But why. For whom. In what sequence. And how to connect those choices across Product, GTM, and Revenue teams.

To break the deadlock, you need a new kind of operating system for growth:

One that starts from your strategic business goals

That works backwards into customer segments, value props, features, and GTM paths

That can simulate multiple scenario trees

That can score each path by impact and fit

And that can continuously update when new data comes in

In short, you need expensive data gaps solved so strategy can be based on hypothesis trees.

Having AI & Monte Carlo Simulations and Digital Twins may not be magic, but it sure feels like it. It's like having the Marvel Multiverse of possible futures, “modeling thousands of scenarios of product and GTM decisions," and being able to pre-test for deep clarity on the best next steps.

What happens when you do this?

Your product roadmap becomes self-prioritizing.

Your GTM campaigns ladder up to actual business impact.

Your team builds conviction — because they see the ‘why.’

And your growth loop finally compounds.

Because strategy isn’t a slide. It’s a simulation of 'how do you plan to win.'

If you’re working through this...

...you’re not alone. This is the inflection point where good teams stall. And great teams evolve.

Because the future isn’t just about building faster. It’s about choosing better.

And that starts by asking:

“What if we could simulate our strategy before we bet the quarter on it?”

Comments